A petty cash fund is a small amount of cash, usually less than $500, used to cover incidentals or petty expenses.

Need some postage stamps? Go to the petty cash.

Stapler broken? Petty cash.

Reimbursing an interview candidate who needed to pay for parking? Petty cash.

Pizza for the team working after-hours? Petty cash.

Petty cash funds are small but need to be adequately managed. You’ll want to ensure that the money isn’t mishandled, and you’ll want to make sure that those little expenses are accounted for when tax time rolls around. Here’s how to set up an effective, easy-to-manage petty cash system.

Setting Up Petty Cash Funds

You can set up your petty cash float – the maximum, fixed amount of on-hand cash – by cashing a check, usually ranging from $100 to $500.

- Determine an amount sufficient to cover small expenses over a designated period, usually one month.

- Add a petty cash account to your chart of accounts.

- Place the petty cash in a designated container.

- Determine who will monitor, track, and record petty cash expenses.

- Establish clear and concise conditions for the use of petty cash funds.

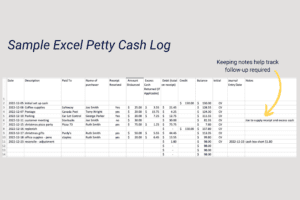

- Start a petty cash book or spreadsheet and balance it regularly to ensure all transactions are accounted for. Include the date, transaction details, the cash in put, the amount distributed, and a running balance.

Managing and Recording Petty Cash Funds

- Any money disbursed out of the petty cash fund must have a receipt. The receipt will show the amount spent and what was purchased.

- Ensure all change from funds disbursed is returned to petty cash.

- Enter the purchase amount in the expense column.

- Replenishes the fund when your running balance hits your replenishment amount. Write a check to return the petty cash total to the original funded amount.

- Cash top-ups and other additions to petty cash go in the credit column.

Reconcile Petty Cash Funds

- If petty cash is used infrequently, reconcile monthly. In the case of daily use, a weekly or bi-weekly reconciliation is more appropriate.

- Match your receipts with the amounts recorded in the petty cash book.

- Deduct your expenses and add your credits to the starting balance. The total is your ending balance; it should match your cash on hand.

- Once the account is reconciled, record your expenses in the general ledger.

Establishing Internal Controls for Petty Cash Funds

- You don’t want to use petty cash for high-priced expenses, so set a dollar limit, such as $25.00. Anything over that amount would be paid for or reimbursed using other means.

- No money may be loaned or borrowed from the fund for personal use.

- The fund may not be used to cash personal checks.

- Mishandling of funds may result in dismissal and/or prosecution of involved employees.

Reassess the petty cash fund periodically

- If you find yourself going through petty cash rapidly, you can increase how much you keep on hand.

- Take a few minutes to see what you’re spending petty cash on.

Petty cash is a useful tool for small and medium-sized businesses as it keeps money available for small expenses. Recording those expenses helps to budget for future ones, and even though those might be small, they add up. When all disbursements are recorded diligently, and the money is replenished regularly, using petty cash can be a real timesaver.

What Are the Challenges with Petty Cash Management?

Petty cash funds can be misused. Cash in a lock box creates unique challenges, demanding an effective management system.

- With petty cash on hand, there is an increased tendency to spend money freely without attention to detail, leading to a missing or inadequate paper trail and sometimes fraud or theft.

- Maintaining them, keeping records, and reconciling them regularly all involve extra work for someone.

KEY TAKEAWAYS

- Petty cash is a nominal amount of money readily accessible for paying expenses too small to merit writing a check or using a debit or credit card.

- A petty cash fund can be used for office supplies, customer cards, flowers, paying for a catered lunch, or reimbursing employees for expenses.

- Petty cash’s main advantages are its quick, convenient, and easy-to-understand use.

- Disadvantages of petty cash funds include their vulnerability to theft and misuse and the need to monitor and balance them periodically.

We Can Help

Of course, overseeing a petty cash fund will still add another layer — albeit a small one — to your bookkeeping. Contact us if you need help establishing a petty cash fund and its conditions.

Of course, overseeing a petty cash fund will still add another layer — albeit a small one — to your bookkeeping. Contact us if you need help establishing a petty cash fund and its conditions.

Sometimes, you just need a little help from a pro –

Check out our Bookkeeping Services for Small Business

Although this blog offers business advice, this content is for general informational purposes only—it is not intended to replace the guidance of a licensed legal or financial professional. Information created by third parties that we may link out to or feature on our site is not endorsed by us and remains the responsibility of such third parties. The Rayne Firm assumes no responsibility for errors or omissions in the content.