The end of the year is a busy time. Prepping for the holidays, making time for family, and planning our workload in hopes of a few days off over the holidays.

As a small business owner, your list is even longer with financial statements, taxes, employee incentives, budgeting, and prepping for 2024.

To help you with this process, we’ve created an accounting checklist highlighting some key areas to focus on as you wrap up the year.

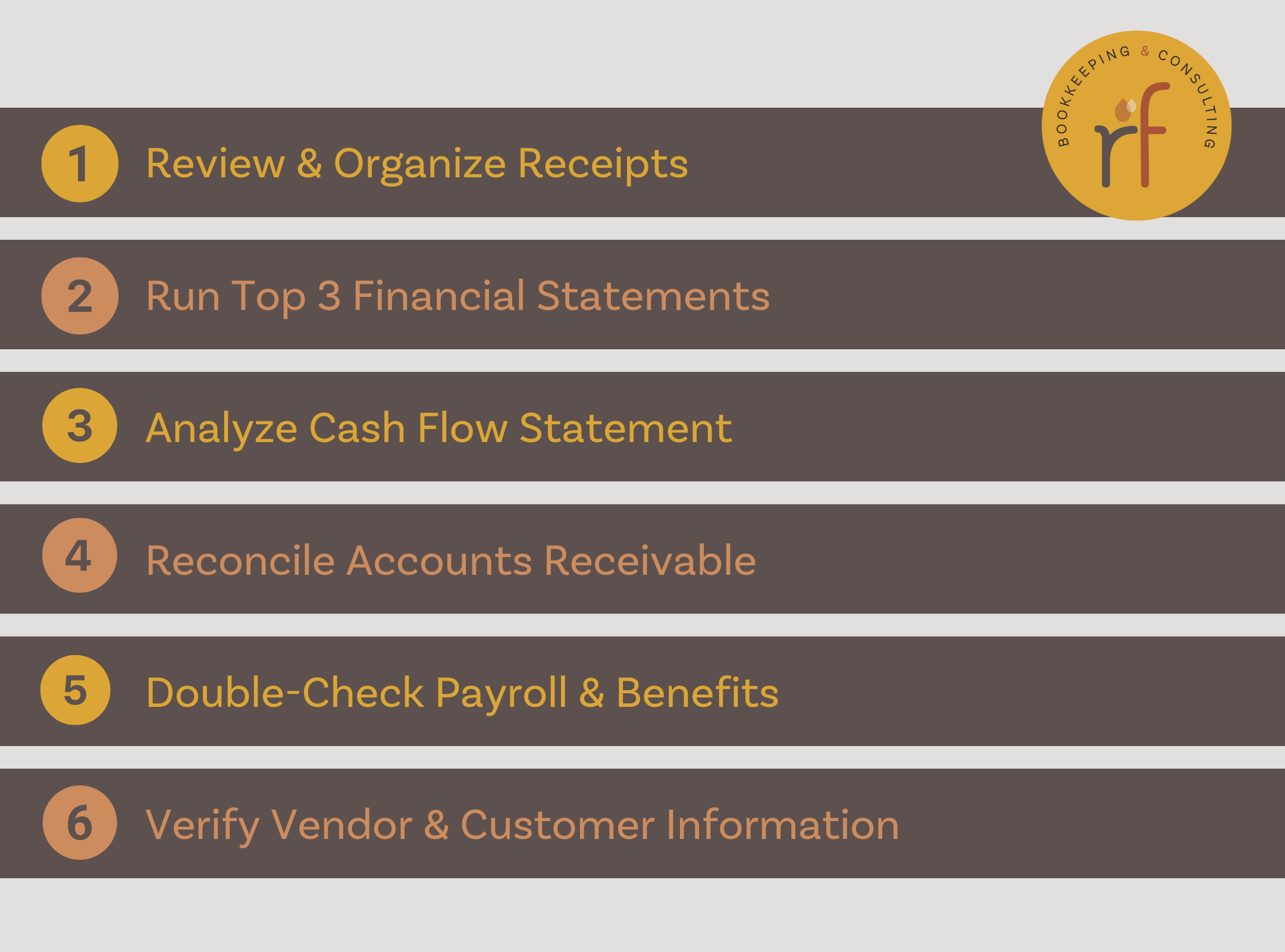

Year End Accounting Checklist

Review and Organize Receipts

Failure to stay on top of your receipts will lead to errors in your accounting records, stress you out at tax time, and may lead to overpaying taxes if you miss expenses.

Tracking your receipts is easiest if you have a system in place to record and file them as you go. If you don’t have a system in place, use this time to set one up. Some tips:

- Organize by type of expense

- Organize your receipts using folders, tags, or even envelopes

- Record receipts at the time purchases are made

- Back up receipts digitally by scanning them or taking pictures

Pro Tip: Use a service like Hubdoc to easily capture and manage expenses and feed them directly into your accounting system. Read more about how to set thus up in our post, Streamline Your Business.

Run Top 3 Financial Statements: Income Statement, Balance Sheet, & Cash Flow Statement

The “big three” financial statements are the best way to see, at a glance, where your business stands financially.

If your profits are lower than expected, you should make some changes as you head into the new year. If your profits are higher than expected, it might be a good time to make larger purchases for which you can record future depreciation.

Speak with a professional before making big purchases to ensure you have the cash on hand, and to understand depreciation rules.

Analyze cash flow statements

It’s a good idea to review your cash flow statements quarterly. Here are some things to look at for expenses:

- Review by category, for example, advertising

- Look for areas where you spent a lot of money

- Was it worth it?

- Did my advertising work? Did I go out to eat too much?.. Or have too many coffees?.. mmm coffee

Pro Tip: It’s easy to lose track of unused subscriptions, especially if you’ve set them up via auto-pay. Small recurring costs can add up quickly. Auditing these regularly will cut costs and keep your organization lean.

Reconcile accounts receivable

Run a report of unpaid invoices and make a plan to collect. Reconciling your AR will boost your cash flow and allow you to start the new year without outstanding invoices (and with cash in the bank).

Double-check payroll and benefits

Identify any issues or corrections to your payroll before the year’s end. Ensure easily forgotten benefits, such as educational reimbursement, health and life insurance, and company car, are accounted for.

Verify vendor & customer information

A lot can change in a year. December is a good time to verify your customers’ and vendors’ information. Check that phone numbers, email addresses, and contact names are accurate and up-to-date.

If time permits, evaluate your vendor relationship and look for opportunities to negotiate better deals in 2023.

Take some time to do this now so you can be present and relaxed over the holidays, and give your business a running start in January.

Join our Profit Club newsletter to get more helpful tips and info on building a profitable business.